Getting The Transaction Advisory Services To Work

The 30-Second Trick For Transaction Advisory Services

Table of ContentsNot known Facts About Transaction Advisory ServicesTransaction Advisory Services Fundamentals ExplainedThe Basic Principles Of Transaction Advisory Services Transaction Advisory Services Can Be Fun For EveryoneThe Main Principles Of Transaction Advisory Services

And figure that Big 4 firms could use much easier pathways right into higher-paying jobs in finance, consulting, and relevant areas. I might take place, yet you obtain the idea. The factor is, everyone arguments the values of these tasks, but there's still a lot of confusion over what "Purchase Providers" suggests.

By contrast, Big 4 TS groups: Job on (e.g., when a possible customer is performing due persistance, or when an offer is closing and the buyer needs to incorporate the firm and re-value the vendor's Equilibrium Sheet). Are with fees that are not linked to the offer shutting efficiently. Gain charges per interaction somewhere in the, which is less than what investment banks earn also on "little bargains" (yet the collection chance is additionally a lot greater).

In comparison to these 3 teams, the and teams are much closer to investment banking. The Corporate Finance team at the majority of Huge 4 companies is an inner investment bank that implements entire M&An offers from beginning to finish. The experience is more relevant for IB/PE duties, but these CF groups likewise tend to service smaller deals than the FDD groups.

The Ultimate Guide To Transaction Advisory Services

, however they'll concentrate more on bookkeeping and assessment and less on topics like LBO modeling., and "accounting professional just" subjects like trial balances and just how to walk with events making use of debits and credits instead than economic statement changes.

that demonstrate exactly how both metrics have changed based on products, channels, and consumers. to judge the precision of monitoring's previous forecasts., including aging, supply by item, average levels, and stipulations. to establish whether they're totally fictional or rather credible. Specialists in the TS/ FDD teams might additionally interview administration regarding whatever above, and they'll compose an in-depth record with their findings at the end of the procedure.

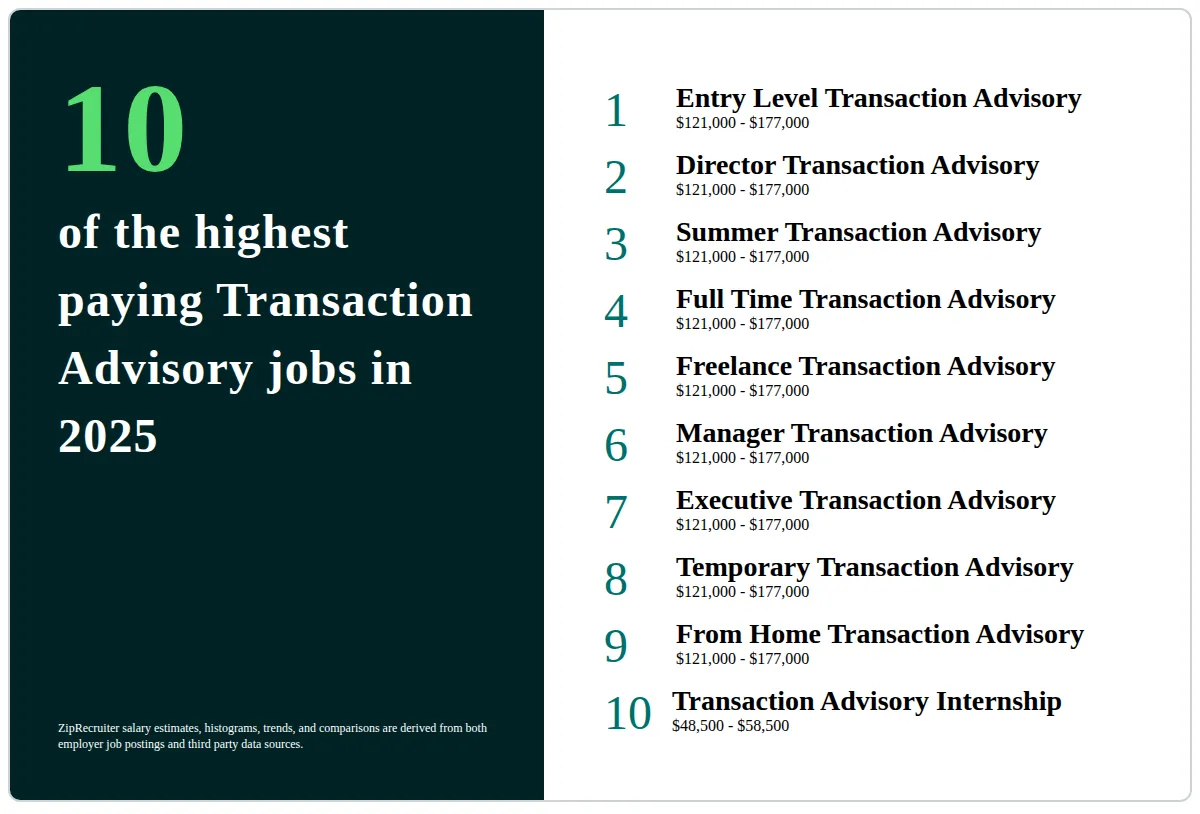

The power structure in Deal Providers differs a bit from the ones in financial investment financial (Transaction Advisory Services) and private equity professions, and the basic form looks like this: The entry-level role, where you do a great deal of information and economic evaluation (2 years for a promotion from here). The next degree up; similar work, but you get the even more intriguing little bits (3 years for a promotion).

Particularly, it's tough to obtain advertised past the Supervisor degree due to the fact that few people leave the work at that phase, and you require to begin revealing proof of your capability to produce profits to breakthrough. Allow's begin with the hours and way of living because those are much easier to explain:. There are periodic late nights and weekend break work, but nothing like the frenzied nature of financial investment banking.

Indicators on Transaction Advisory Services You Should Know

There are cost-of-living adjustments, so anticipate lower compensation if you're in a less expensive place outside major monetary. For all positions other than Partner, the Continue base wage consists of the bulk of the complete payment; the year-end incentive could be a max of 30% of your base salary. Usually, the very best means to enhance your earnings is to change to a various firm and bargain for a higher salary and perk.

You could get right into business growth, but financial investment banking gets extra challenging at this phase because you'll be over-qualified for Analyst duties. Company finance is still an option. At this phase, you ought to simply remain and make a run for a Partner-level role. If you intend to leave, possibly move to a customer and execute their appraisals and due diligence in-house (Transaction Advisory Services).

The main problem is that since: You generally need to join an additional Big 4 group, such as audit, and work there for a few years and after that relocate right into TS, job there for a couple of years and afterwards move into IB. And there's still no assurance of winning this IB duty due to the fact that it depends on your area, customers, and the employing market at the time.

The Best Strategy To Use For Transaction Advisory Services

Longer-term, there is additionally some threat of and because examining a business's historic monetary details is not precisely brain surgery. Yes, people will certainly constantly require to be involved, yet with even more advanced innovation, lower headcounts might possibly sustain client interactions. That stated, the Transaction Providers group defeats audit in terms learn this here now of pay, work, and leave chances.

If you liked this article, you could be curious about reading. (Transaction Advisory Services)

Transaction Advisory Services Can Be Fun For Anyone

For Colorado & Illinois Candidates: We are happy to use eligible staff a robust benefits plan. Eligibility and payment requirements for some of these benefits vary based on the number of hours team work per week.

A Pension plan is also readily available for qualified administrative and paraprofessional personnel. An optional perk plan is offered for eligible team. Plante Moran additionally uses Interns and Specialists try this website the choice to choose medical insurance under our contingent staff medical strategy as of the 1st of the month complying with 60 days of work along with minimal paid time sick time.

Assume of it as being the financial doctor for business going through significant surgery. They take a look at the firm's health, determine the threats, and assist ensure the entire point goes efficiently. It's not just concerning crunching numbers; it's likewise regarding comprehending business, the market, and individuals involved.